mirkuhni74.ru

Community

Where Is The Federal Tax Id Number

The Federal Employer Identification Number (FEIN), is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to business entities operating. The Internal Revenue Service (IRS) assigns companies an Employer Identification Number (EIN) upon application. However, not all corporate entities are. The best place to look your employer's EIN (Employer Identification Number) or Tax ID is in Box b of your W-2 form. Look for a 9-digit number. To obtain an EIN, you must complete Form SS-4, Application for Employer Identification Number. After you have completed the Form SS-4, you can apply online, by. An Employer Identification Number (EIN) is used to identify a business for tax purposes with the Internal Revenue Service (IRS). An EIN is similar to a. For U.S.-based entities (corporations, partnerships, LLCs, etc.): In general, your TIN is usually the entity's Federal Employer Identification Number (FEIN). You can apply for a FEIN online or download the form through the IRS' website, or can call them at Remember, you must have a Maryland SDAT. If that doesn't work, simply give the IRS a call and provide the necessary information. No matter what, obtaining your EIN should be easy. So, if you've lost it. To obtain an EIN number immediately, apply online (available for most businesses) or call the IRS at () The Federal Employer Identification Number (FEIN), is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to business entities operating. The Internal Revenue Service (IRS) assigns companies an Employer Identification Number (EIN) upon application. However, not all corporate entities are. The best place to look your employer's EIN (Employer Identification Number) or Tax ID is in Box b of your W-2 form. Look for a 9-digit number. To obtain an EIN, you must complete Form SS-4, Application for Employer Identification Number. After you have completed the Form SS-4, you can apply online, by. An Employer Identification Number (EIN) is used to identify a business for tax purposes with the Internal Revenue Service (IRS). An EIN is similar to a. For U.S.-based entities (corporations, partnerships, LLCs, etc.): In general, your TIN is usually the entity's Federal Employer Identification Number (FEIN). You can apply for a FEIN online or download the form through the IRS' website, or can call them at Remember, you must have a Maryland SDAT. If that doesn't work, simply give the IRS a call and provide the necessary information. No matter what, obtaining your EIN should be easy. So, if you've lost it. To obtain an EIN number immediately, apply online (available for most businesses) or call the IRS at ()

By Phone – If you're an international applicant, you may call the IRS at to obtain your EIN. If you ask someone to call on your behalf, that person. An FEIN is the identifying number that the federal Internal Revenue Service (IRS) uses to identify a business based on payroll and tax records. This form of. An IRS individual taxpayer identification number is generally identified in the records and database of the Internal Revenue Service as a number belonging to a. An Employer Identification Number (EIN) is a nine-digit ID assigned by the Internal Revenue Service (IRS). One of five Tax ID Numbers (TINs), it's used to. An EIN must come from the IRS in order to be a federal tax ID number, and it is used to identify a business entity. You may apply for a Minnesota Tax ID number with the Minnesota Department of Revenue online at Business Registration, by phone at or A federal tax ID number is a unique 9-digit number that's assigned to a business or organization by the Internal Revenue Service (IRS). It identifies your. The Employer Identification Number (EIN) is a unique federally issued nine-digit number assigned by the Internal Revenue Service (IRS) to business entities. UCLA's federal taxpayer ID number is A department may respond to a request for UCLA's federal TIN by providing either of the following documents. This number is also referred to as a Federal Tax ID Number. Generally, all businesses need an FEIN. Many one-person businesses use their Social Security Number. The Employer Identification Number (EIN), also known as the Federal Employer Identification Number (FEIN) or the Federal Tax Identification Number (FTIN). Taxpayer Identification Number (TIN) and Employer Identification Number (EIN) are defined as a nine-digit number that the IRS assigns to organizations. Note: A federal employment identification number (FEIN) is the same thing as an employer identification number (EIN). The only exception to this rule is when. What is a federal identification number (fein) and how do I receive one? It is a nine-digit number assigned by the Internal Revenue Service (IRS). The IRS. An employer identification number (EIN) is a unique nine-digit number that is assigned to a business entity. Every business needs an employer identification. It is best to prepare in advance by completing Form SS-4, the Application for Employer Identification Number, to be sure you have all the necessary information. A Tax Identification Number (TIN) is a nine-digit number used by the Internal Revenue Service (IRS) to identify taxpayers. A Federal ID Number, also known as a Federal Tax Identification Number, is a nine-digit number issued by the IRS and arranged as follows: Step 1: Obtain a Federal Employer Identification Number · Step 2: Register your business with the Vermont Secretary of State · Step 3: Register for a business tax.

What Can You Use Vpn For

A VPN adds a layer of privacy protection to your online activities by routing your traffic through an encrypted tunnel between you and anyone who tries to spy. It means your device or network connects to Netflix through a VPN or proxy service. VPNs can change or hide your internet location, which may cause issues. The ability to add VPN connections to a deco network is currently being rolled out to various deco models, starting with the deco x Both the ISP and business cloud VPN can provide you with a public static IP address. This IP address can be either dedicated or shared. The difference. When Should You Use a VPN? Whenever communications may be exposed to interception, eavesdropping, spoofing, hijacking, or adversary-in-the-middle attacks —. If you are working from home and not connected to your company network, you can connect to your company's private network using VPN. This process is quite. A VPN, which stands for virtual private network, protects its users by encrypting their data and masking their IP addresses. This hides their browsing activity. VPN usually slows down your connection by 10%to 25% depending on the service, all thanks to encryption overhead, which can be frustrating. VPNs connect you to a different location and hide your IP address, which helps to bypass censorship/geo-restrictions. Unlock internet freedom in. A VPN adds a layer of privacy protection to your online activities by routing your traffic through an encrypted tunnel between you and anyone who tries to spy. It means your device or network connects to Netflix through a VPN or proxy service. VPNs can change or hide your internet location, which may cause issues. The ability to add VPN connections to a deco network is currently being rolled out to various deco models, starting with the deco x Both the ISP and business cloud VPN can provide you with a public static IP address. This IP address can be either dedicated or shared. The difference. When Should You Use a VPN? Whenever communications may be exposed to interception, eavesdropping, spoofing, hijacking, or adversary-in-the-middle attacks —. If you are working from home and not connected to your company network, you can connect to your company's private network using VPN. This process is quite. A VPN, which stands for virtual private network, protects its users by encrypting their data and masking their IP addresses. This hides their browsing activity. VPN usually slows down your connection by 10%to 25% depending on the service, all thanks to encryption overhead, which can be frustrating. VPNs connect you to a different location and hide your IP address, which helps to bypass censorship/geo-restrictions. Unlock internet freedom in.

With a VPN, you can protect your online privacy, bypass internet censorship, and access geo-restricted content. This added privacy helps iPhone users browse. You can also use a VPN with a friend to fool your computers into thinking they are on the same network and play LAN games over the internet. This is useful for. A VPN can protect your identity by blocking online trackers from following you around the internet. With your VPN on, trackers will think all of your browsing. You can use a VPN for cheaper subscriptions and other purchases, like flights and hotels. A VPN app lets you see prices from all around the world. Yes, it is possible to use a VPN on another VPN. This is known as "VPN chaining" or "VPN nesting." In this setup, traffic is first routed. A common misconception is that using a VPN is redundant if you only plan on browsing HTTPS websites since both practices rely on solid data encryption. Most VPN apps allow you to do this with a click of a button. With NordVPN, for example, you simply open the app and click the Quick Connect button. The app. A virtual private network (VPN) is an Internet security service that creates an encrypted connection between user devices and one or more servers. VPNs can. A good VPN is an indispensable part of any traveler's digital tool kit. It's a cheap way to take the necessary precautions to protect yourself online. Using a. Tap Connect. If you use a VPN app, the app opens. Tip: When you're connected, you'll see VPN on. Websites categorize users by their physical IP address (the one your internet service provider assigned you), but you can use a VPN to hide your real location. While using Netflix through a VPN, we will only show you TV shows and movies we have worldwide rights for, like Squid Game or Stranger Things. As a result, your online experience is safer, more secure, and more anonymous. Now that you know what a VPN is, let's explore the safety benefits of using one. Get a unique IP address that only you can use. This is great if you want all the benefits of a VPN — like accessing restricted content and hiding online. The benefits of using a VPN are vast. One of the most important is the fact that businesses can effectively secure their network. The benefits of using a VPN are vast. One of the most important is the fact that businesses can effectively secure their network. Staying secure on a public network is vital, and using a VPN connection helps keep your data safe. On an Apple device, you can set up a VPN connection that. A VPN allows you to freely and safely explore the web as often and as long as you wish. There are no caps on how much data you can use. Because you can bypass. A VPN protects your online privacy by hiding your real IP address so you can browse privately, avoid being tracked across the internet, and stop your browsing.

Wire Fees Bank Of America

Send money to friends and family no matter where they bank in the U.S., using the Bank of America Mobile Banking app with Zelle®. The SWIFT/BIC for your recipient's bank. A SWIFT code or Bank Identification Code (BIC) identifies the bank that will receive your wire transfer. If you don. $30 for each outbound transfer sent with the U.S.. International wire transfer fees, $35 for outgoing wire transfers in foreign currency, or $45 outgoing wire. IF YOU HAD A CONSUMER CHECKING AND/OR SAVINGS ACCOUNT WITH BANK OF AMERICA, N.A., AND PAID CERTAIN WIRE TRANSFER FEES ON INCOMING PAYMENTS INTO YOUR ACCOUNT. BECU charges $25 to send a domestic wire transfer, and $35 to send an international wire transfer. Every wire sent will post as a separate transaction. Wires. Learn how to send or receive money through Bank of America Wire Transfer. Get step-by-step instructions, fees and estimated processing times. Domestic wires — outbound (send). $ International wires — outbound (send). • Send in foreign currency. $0 (no fee). • Send in U.S. dollars. $ You have. Bank of America offers wire transfers as a convenient way for customers to send money overseas - learn more about its rates and fees. Outgoing foreign wire transfers sent in US Dollars are $45 per transaction. There is no incoming wire transfer fee for an Advantage Relationship Banking account. Send money to friends and family no matter where they bank in the U.S., using the Bank of America Mobile Banking app with Zelle®. The SWIFT/BIC for your recipient's bank. A SWIFT code or Bank Identification Code (BIC) identifies the bank that will receive your wire transfer. If you don. $30 for each outbound transfer sent with the U.S.. International wire transfer fees, $35 for outgoing wire transfers in foreign currency, or $45 outgoing wire. IF YOU HAD A CONSUMER CHECKING AND/OR SAVINGS ACCOUNT WITH BANK OF AMERICA, N.A., AND PAID CERTAIN WIRE TRANSFER FEES ON INCOMING PAYMENTS INTO YOUR ACCOUNT. BECU charges $25 to send a domestic wire transfer, and $35 to send an international wire transfer. Every wire sent will post as a separate transaction. Wires. Learn how to send or receive money through Bank of America Wire Transfer. Get step-by-step instructions, fees and estimated processing times. Domestic wires — outbound (send). $ International wires — outbound (send). • Send in foreign currency. $0 (no fee). • Send in U.S. dollars. $ You have. Bank of America offers wire transfers as a convenient way for customers to send money overseas - learn more about its rates and fees. Outgoing foreign wire transfers sent in US Dollars are $45 per transaction. There is no incoming wire transfer fee for an Advantage Relationship Banking account.

Note: There are no outbound wire transfer fees if sent in foreign currency. Markups are included in Bank of America exchange rates, which are determined by Bank. Bank of America International Wires: Fees, Limits, and More · $45 transaction fee for outbound international wires. · 5% to 7% exchange rate margin. · . Transfer fees will vary depending on your bank or credit union, but can usually range between $0-$ International bank transfers may require additional. Wire Transfers · Wires less than $5, - $45 per wire transfer · Wires $5, or more - $75 per wire transfer. For international wire transfers, fees can range from $15 and $25 for the receiver and $35 to $50 for the sender. International wire transfers can only be. The pros and cons of using Bank of America · For an international wire sent out in US dollars, you'll be charged wire transfer fees of $ · If you are sending. If prompted to select delivery speed, select Same business day, Wire Transfer. Screenshot of Bank of America Online Banking, "Make Transfer" tab, with ". Move money or setup a future transfer within the Mobile Banking app or Online Banking. Transfers can be set up between your Bank of America accounts. How Much Does a Wire Transfer Cost? · Bank of America (only outgoing international sent in foreign currency using current exchange rates instead of U.S. dollars. Wire Transfers · Incoming domestic wire transfer fees are $15 per transaction. · Incoming foreign wire transfer fees are $16 per transaction. · Outgoing domestic. No Excess Transaction Fee for debit card transactions, electronic debits, and checks deposited through Mobile. Check Deposit, Bank of America ATM, or Remote. Just enter the amount to transfer and the recipient will receive a text or email with instructions on how to receive it. Fees: Most standard transfers are no-. It's free and should take around 24 hours. There is generally no free, immediate way to transfer that amount of money to a different bank's. International Wire Transfer Fees at Bank of America · BoA incoming foreign wire transfers are $16 per transaction · BoA outgoing foreign wire transfer sent in. In general, using Bank of America for a domestic wire transfer takes around days, with international wire transfers taking around Typically, these. Learn more about Bank of America account fees, including monthly maintenance fees for checking and savings accounts. Review additional fees here. The pros and cons of using Bank of America · For an international wire sent out in US dollars, you'll be charged wire transfer fees of $ · If you are sending. submitted to the appropriate Bank of America Merrill Lynch examination center in a digital format to satisfy the LorC requirements). Note: additional fees. Wire transfers may be a quick way to transfer money without using physical cash, but they cost you for the convenience. For this service, banks typically charge. Bank of America¹. Incoming: not disclosed. Outgoing: $ Incoming: not disclosed. Outgoing: $45 in USD, $0 in a foreign currency ; Wells Fargo². Incoming: $

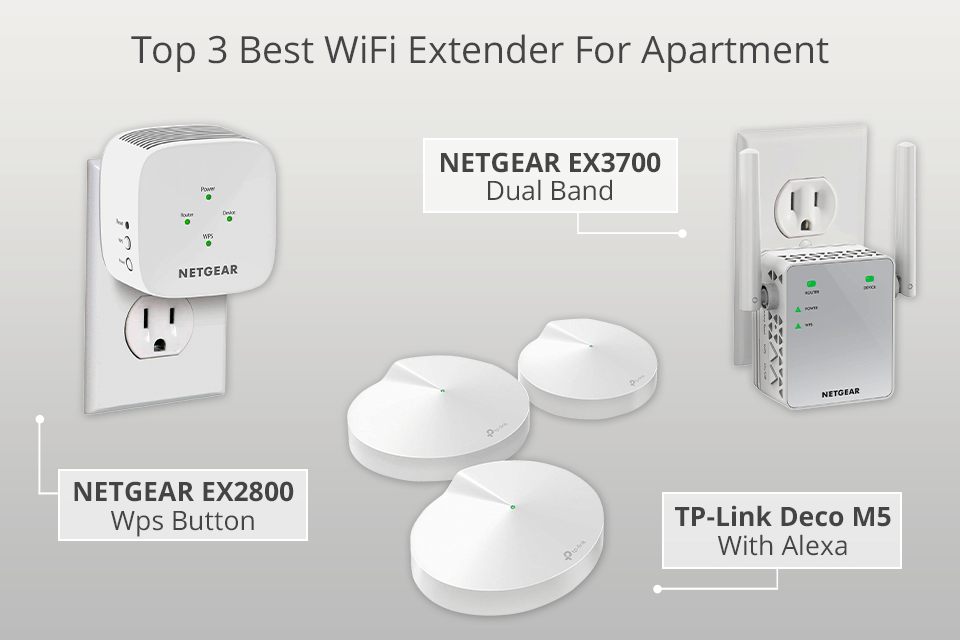

Wifi Extender For Second Floor

A range extender increases WiFi coverage by connecting to your existing WiFi router and creating a separate WiFi network that has its own name and security. Another option is regular range extenders or a mesh network. Just be aware that your latency will increase with the wireless extenders. Edit. I have very poor Wifi on the second floor. Speedtest allways show something between mbit Download. When connected by cable I will get the whole Gigabit. A couple of U6-Extenders - one each on the first and second floors - would make placement changes easy so you can move them around until you get the right mesh. A range extender increases WiFi coverage by connecting to your existing WiFi router and creating a separate WiFi network that has its own name and security. As the cheapest model in our top picks, the TP-Link RE performed well only when positioned on the first floor of our test home. Once on the second or third. One can purchased a WiFi repeater or extender. It is a device that plugs into the AC wall outlet and relays WiFi data. WiFi Extender Fastest WiFi Long Range Extenders Booster Covers Up to mirkuhni74.ru and 40 Devices Wireless Internet Repeater and Signal Amplifier for Home. One of the best ways to boost the weak WiFi signal upstairs is to use a WiFi extender or repeater. Both devices can amplify the WiFi signal and extend its range. A range extender increases WiFi coverage by connecting to your existing WiFi router and creating a separate WiFi network that has its own name and security. Another option is regular range extenders or a mesh network. Just be aware that your latency will increase with the wireless extenders. Edit. I have very poor Wifi on the second floor. Speedtest allways show something between mbit Download. When connected by cable I will get the whole Gigabit. A couple of U6-Extenders - one each on the first and second floors - would make placement changes easy so you can move them around until you get the right mesh. A range extender increases WiFi coverage by connecting to your existing WiFi router and creating a separate WiFi network that has its own name and security. As the cheapest model in our top picks, the TP-Link RE performed well only when positioned on the first floor of our test home. Once on the second or third. One can purchased a WiFi repeater or extender. It is a device that plugs into the AC wall outlet and relays WiFi data. WiFi Extender Fastest WiFi Long Range Extenders Booster Covers Up to mirkuhni74.ru and 40 Devices Wireless Internet Repeater and Signal Amplifier for Home. One of the best ways to boost the weak WiFi signal upstairs is to use a WiFi extender or repeater. Both devices can amplify the WiFi signal and extend its range.

With powerline adapters, you'll need two units — one that you plug into the router or modem and another that is placed near the desired access. A plug-in WiFi extender is a popular choice for these scenarios, offering a quick, simple solution to the issues faced. One can purchased a WiFi repeater or extender. It is a device that plugs into the AC wall outlet and relays WiFi data. One of the best ways to boost the weak WiFi signal upstairs is to use a WiFi extender or repeater. Both devices can amplify the WiFi signal and extend its range. One of the best ways to boost the weak WiFi signal upstairs is to use a WiFi extender or repeater. Both devices can amplify the WiFi signal and extend its range. I have very poor Wifi on the second floor. Speedtest allways show something between mbit Download. When connected by cable I will get the whole Gigabit. WiFi extender rebroadcasts your WiFi signal from your router as a new, different WiFi signal. You'll connect to the main router WiFi when you're downstairs, but. 6. Add a wireless repeater Wireless repeaters are handy devices that rebroadcast a wireless signal, strengthening the signal from your router to other floors. If this is the signal strength issue you are facing, consider WiFi extenders to boost the reach of your WiFi signal throughout your home. If you are not sure on. TP-Link AC WiFi Extender (RE), Covers Up to mirkuhni74.ru and 35 Devices, Mbps Dual Band Wireless Repeater, Internet Booster, Gigabit Ethernet Port. I have very poor Wifi on the second floor. Speedtest allways show something between mbit Download. When connected by cable I will get the whole Gigabit. You can either fit it on a upper surface of your first floor or choose a not-so-high area on the second floor. Doing so will help you enjoy seamless internet. Add a wireless repeater Wireless repeaters are handy devices that rebroadcast a wireless signal, strengthening the signal from your router to other floors or. A WiFi extender connects to your router and then becomes part of your network. The extender uses radio waves to distribute your internet connection as a. For better coverage in a two-storey home, it's best to place your router on a high shelf near the ceiling on the first floor or on the ground on the second. If this is the signal strength issue you are facing, consider WiFi extenders to boost the reach of your WiFi signal throughout your home. If you are not. Wi-Fi boosters and extenders are very similar, but they also amplify the existing signal before rebroadcasting it to create a second network. Because Wi-Fi. Yes, you can have multiple Wi-Fi extenders. For large homes or multi-floor offices, Wi-Fi extenders are essential tools to extend your router's service. WiFi Network Extenders are the best WiFi boosters for consistent, reliable high speed WiFi to every floor and corner of your home. Unlike repeaters or range. With a WiFi repeater you can effectively double the coverage area of your WiFi network - reaching far corners of your home or office, different floors, or even.

Is There A Way To Negotiate Credit Card Debt

Options may include a partial settlement, a workout agreement, or even payment reduction for a few months. There are key steps to negotiating credit card debt. One thing that might come out of a negotiation with your creditors, is the availability of a debt consolidation loan. If you have multiple different credit card. It can also make repayment less expensive by combining the debts into a new loan or credit card with a lower interest rate. However, consolidation typically. Debt settlement programs are typically offered by for-profit companies to people with significant credit card debt. The companies negotiate with your creditors. Which means, they have little say to the credit bureaus. By law, all they can do is send a settled status on the debt. By getting it in writing. Stay calm and professional. Negotiations can be tense, and remaining composed shows you're serious and committed to resolving the issue. · Be honest but brief. It can also make repayment less expensive by combining the debts into a new loan or credit card with a lower interest rate. However, consolidation typically. Settling your credit card debt typically means that you negotiate an agreement to repay a portion of your balance, because you are facing hardships that. If you're drowning in credit card debt, a call to a nonprofit credit counseling agency can help you choose the debt-relief option best suited to your. Options may include a partial settlement, a workout agreement, or even payment reduction for a few months. There are key steps to negotiating credit card debt. One thing that might come out of a negotiation with your creditors, is the availability of a debt consolidation loan. If you have multiple different credit card. It can also make repayment less expensive by combining the debts into a new loan or credit card with a lower interest rate. However, consolidation typically. Debt settlement programs are typically offered by for-profit companies to people with significant credit card debt. The companies negotiate with your creditors. Which means, they have little say to the credit bureaus. By law, all they can do is send a settled status on the debt. By getting it in writing. Stay calm and professional. Negotiations can be tense, and remaining composed shows you're serious and committed to resolving the issue. · Be honest but brief. It can also make repayment less expensive by combining the debts into a new loan or credit card with a lower interest rate. However, consolidation typically. Settling your credit card debt typically means that you negotiate an agreement to repay a portion of your balance, because you are facing hardships that. If you're drowning in credit card debt, a call to a nonprofit credit counseling agency can help you choose the debt-relief option best suited to your.

moving a payment date · reducing the interest rate · asking for a temporary payment reduction. · entering into a forbearance agreement, which requires no payments. Try to negotiate away the late fees that have been assessed for lack of payment. These fees are what can ultimately tank your credit score. Step 4: Make an. Debt settlement companies encourage you to stop paying credit card bills and instead require regular payments into a third-party account they manage until the. The debt settlement process typically takes three-to-four years. First, you have to put ample funds into the settlement account. Then, the settlement firm has. Negotiating credit card debt relief means asking your credit card companies to lower the interest rates they are charging you. If you're carrying a balance, a. Five Steps to Debt Negotiation Here is an introductory look at the process. Step 1: Stopping Creditor Phone Calls While it is a mistake to just ignore. It's the strategy of combining multiple credit card debts into a single payment, often with a lower interest rate. A balance transfer is one way to do that. If you have a large credit card balance, you might be able to negotiate a debt settlement or agreement with your card issuer to manage it. But before you. 1. Contact your credit card companies · 2. Understand the two ways to pay off credit card debt · 3. Consider a debt management plan · 4. Participate in credit. Credit card debt settlement is a financial risk because you must go into it with the understanding that it will damage your credit. Your current credit score. Debt settlement involves offering a lump-sum payment to a creditor in exchange for a portion of your debt being forgiven. · You can attempt to settle debts on. You can try to negotiate lower payments if you are struggling with payments. Creditors may allow you to pay less, but this will be marked on your credit file. Negotiate with a debt collector Negotiating with the debt collector is sometimes the least expensive way to resolve a debt. This is because neither side has. How to negotiate credit card debt · Find out how much you owe. Before starting negotiations, check a recent statement or contact your issuer to determine your. Is that possible? Can credit card debt be negotiated down? In many cases, the answer is yes. Your best bet, however, is to obtain the skilled guidance of an. Types of credit card debt settlements · Lump-Sum Settlement: This is the most common type of debt settlement, where you negotiate with the creditor to pay a. A debt settlement company is likely to know which creditors are more inclined to settle and for how much. · A debt settlement program will provide you with the. Step 1: Do your homework · Step 2: Negotiate before paying off debt · Step 3: Start with your oldest credit card · Step 4: Make the call · Step 5: Follow through on. How to negotiate credit card debt · Find out how much you owe. Before starting negotiations, check a recent statement or contact your issuer to determine your. Options may include a partial settlement, a workout agreement, or even payment reduction for a few months. There are key steps to negotiating credit card debt.

Yieldstreet Investments

We empower investors to grow their wealth outside of the stock market by curating private market alternatives from top investment managers. YieldStreet is an online platform for alternative investments, With projected yields of between 8% and 20% Here's our Review with Pros & Cons. Yieldstreet is the leading private market investment platform helping people dive into alternative investing with confidence and ease. Yieldstreet is the leading private market investment platform helping people dive into alternative investing with confidence and ease. Yieldstreet provides the individual investor with a variety of assets in asset classes once reserved for private institutions and the top 1%. 3/5. Yieldstreet investments, focused on high-yield, specialty lending, carry inherent risks higher than traditional investments, primarily due. Yieldstreet empowers investors to grow their wealth outside of the stock market by curating private market alternatives from top investment managers. Diversify beyond the stock market on the leading platform for private market investing. · Statistics's profile picture. Statistics · Asset Classes's profile. Yieldstreet is unlocking access to alternative investments traditionally reserved for the 1%. Power your portfolio with diversification, thanks to unique. We empower investors to grow their wealth outside of the stock market by curating private market alternatives from top investment managers. YieldStreet is an online platform for alternative investments, With projected yields of between 8% and 20% Here's our Review with Pros & Cons. Yieldstreet is the leading private market investment platform helping people dive into alternative investing with confidence and ease. Yieldstreet is the leading private market investment platform helping people dive into alternative investing with confidence and ease. Yieldstreet provides the individual investor with a variety of assets in asset classes once reserved for private institutions and the top 1%. 3/5. Yieldstreet investments, focused on high-yield, specialty lending, carry inherent risks higher than traditional investments, primarily due. Yieldstreet empowers investors to grow their wealth outside of the stock market by curating private market alternatives from top investment managers. Diversify beyond the stock market on the leading platform for private market investing. · Statistics's profile picture. Statistics · Asset Classes's profile. Yieldstreet is unlocking access to alternative investments traditionally reserved for the 1%. Power your portfolio with diversification, thanks to unique.

Information on valuation, funding, cap tables, investors, and executives for YieldStreet. Use the PitchBook Platform to explore the full profile. Yieldstreet is the leading private market alternative investment platform focused on generating income streams for investors. Yieldstreet is an investment platform designed to provide access to alternative market investments. This platform allows individuals to explore and invest. Yieldstreet, founded in , takes a broader approach to alternative asset investing, offering a diverse range of investment opportunities beyond just real. A private market fund built for income. Gain exposure to a wide array of private market investments with a Fund designed to distribute quarterly income. Yieldstreet to acquire real estate investment platform Cadre · Mary Ann Azevedo. pm PST • November 30, Clients with IRAs at Equity Trust can now invest directly in alternative investments on Yieldstreet through a new platform called WealthBridge. Topic. On. YieldStreet has 17 investors. Monroe Capital invested in YieldStreet's Line of Credit - II funding round. Do I need to be an accredited investor to invest in the Prism. Fund? No. The Yieldstreet Prism Fund is open to all investors, regardless of net worth or. Founded in , Yieldstreet offers alternative investments for retail investors across legal, real estate, art, marine, and supply chain finance asset classes. YieldStreet allows investors to effortlessly participate in curated investments with low market correlation and high yield. The company focuses on expanding access to private market investment products. Yieldstreet provides investments in art, real estate, legal, and. A crowdfunding platform that connects investors to asset-based alternative investments. Learn more Launch date Jan Employees people. Yieldstreet empowers investors to grow their wealth outside of the stock [email protected] Park Avenue; ; New York; United States. Yieldstreet is a management platform that provides institutional investors with access to income-generating investment products. Founded in , Yieldstreet. Is Yieldstreet legit? Yes, Yieldstreet is a legitimate alternative investing platform with thousands of investors and a strong track record of returns. It. Yieldstreet says some of its customers were affected by the Evolve Bank data breach · Fintechs go shopping · Yieldstreet to acquire real estate investment. Exclusive access to private market investments · Wide range of alternative investments like art, real estate, legal financing, and more · Goal-based investing for. YieldStreet offers alernative asset-based lending investments. In addition to real estate/hard money loans, it also offers other types of alternative. Is Yieldstreet Legit? Yes, Yieldstreet is a legitimate alternative investment platform that's been up and running since The company is headquartered in.

Business Banking Ratings

Look for business bank accounts that offer no account minimums or fees, digital and mobile-optimized features, and opportunities to earn on savings. What To Look For in a Business Banking Provider · Strong Customer Service · Competitive Fees and Rates · Online Banking Capabilities · Lending Services · Perks and. Compare the best small business bank accounts. We evaluated minimum balances, APYs, fees, and more. Expert-rated picks include Chase, Axos, and LendingClub. Bank with ConnectOne and enjoy our great personal and business banking solutions. Explore our accounts, loans and mortgage options today! A woman in a sleeveless black dress reviews papers in a sunlit office. Solutions for every stage of your business. Much like a credit rating informs lenders about the creditworthiness of people and business entities, bank ratings score financial institutions' health. Read on for our guide on the best banks for small businesses, as well as some money services business providers and credit unions. Compare business checking accounts from U.S. Bank. Use this comparison chart to help you find the business checking account features that meet your needs. We combed through the terms of 16 top banks, assessing their usefulness to small businesses. There is no one “best” bank for all businesses. Look for business bank accounts that offer no account minimums or fees, digital and mobile-optimized features, and opportunities to earn on savings. What To Look For in a Business Banking Provider · Strong Customer Service · Competitive Fees and Rates · Online Banking Capabilities · Lending Services · Perks and. Compare the best small business bank accounts. We evaluated minimum balances, APYs, fees, and more. Expert-rated picks include Chase, Axos, and LendingClub. Bank with ConnectOne and enjoy our great personal and business banking solutions. Explore our accounts, loans and mortgage options today! A woman in a sleeveless black dress reviews papers in a sunlit office. Solutions for every stage of your business. Much like a credit rating informs lenders about the creditworthiness of people and business entities, bank ratings score financial institutions' health. Read on for our guide on the best banks for small businesses, as well as some money services business providers and credit unions. Compare business checking accounts from U.S. Bank. Use this comparison chart to help you find the business checking account features that meet your needs. We combed through the terms of 16 top banks, assessing their usefulness to small businesses. There is no one “best” bank for all businesses.

rated in-store service^ to meet your business banking needs. Bank accounts The Metro Bank App is free to use and available to our Business Bank Account. Bank with ConnectOne and enjoy our great personal and business banking solutions. Explore our accounts, loans and mortgage options today! Business Ready (B-READY) is the World Bank's new flagship report benchmarking the business environment and investment climate in most economies worldwide. Capital One business banking is a good choice for businesses that make frequent digital transactions and prefer to manage their accounts online. It's a good. A business credit rating is based on how well – or poorly – your company manages paying its bills. Conversely, the criteria used to determine a bank rating is. This will give your banker a stronger sense of your financial picture. Low consumer and business credit scores could limit your access to specific account. SMALL BUSINESS BANK, W 92nd St, Lenexa, KS , 7 Photos, Mon - am - pm, Tue - am - pm, Wed - am - pm. Live Oak Bank is our top choice for best business checking accounts. The company was created specifically to support small businesses and entrepreneurs. Start with a banking bundle that's built for business starters like you. You have the flexibility to upgrade anytime. Local relationship bank, Handelsbanken, has retained its top-ranking position in the CMA independent service quality survey for business banking. Looking for the best business bank account. Options that ive researched are: Chase Business Banking - NOVO Business Banking (Online) - Mercury Business. How many stars would you give Small Business Bank? Join the people who've already contributed. Your experience matters. Business banking designed for small business owners and the self-employed. Simplify taxes, bookkeeping and more. No hidden fees or monthly minimums. As a Bauer 5 Star Rated Bank, the highest possible rating for a financial institution, we stand ready to serve our clients and surrounding communities. Canadian Imperial Bank of Commerce (CIBC) is a North American financial institution with four strategic business In comparison to other banks, it ranks 71st. We've compiled the account features and downsides of the top 13 banks for small businesses and their mobile apps to help you find the right fit for your. Bank wherever you are, whenever you want with the Republic Bank Mobile Business Banking app. Republic Bank of Chicago BBB Business Review. Copyright © Business owners looking for affordable, flexible banking options might consider one of Chase's business checking accounts. With three options to choose from. Each rating agency has its own methodology for evaluating banks. Moody's, for example, uses a rating scale that ranges from Aaa to C, with Aaa being the highest. Weiss Bank and Credit Union ratings are safety ratings based on a business and economic scenarios that may impact the company's net interest.

When Best To Refinance Mortgage

Generally, a mortgage refinance is a good idea if it will save you money. Mortgage experts say you should consider this move if you can lower your interest rate. If your goal is to reduce your monthly payments as much as possible, you will want a loan with the lowest interest rate for the longest term. If you want to pay. If rates drop significantly and can result in substantial savings, then refinancing is worth considering. However, it's crucial to weigh the. In this case, refinancing may make it possible to obtain a lower interest rate or receive approval for a loan type that was previously unavailable to you. You. If rates drop significantly and can result in substantial savings, then refinancing is worth considering. However, it's crucial to weigh the. Generally speaking, you can benefit from mortgage refinancing if interest rates have dropped since you took on your mortgage. If you took out a mortgage. Most experts recommend refinancing a mortgage if you can lower your current interest rate by at least to 1 percent. Also, it's a good idea not to plan to. To Capitalize on a Lower Interest Rate and Payment. It's always wise to refinance your mortgage if the refinancing option's interest rates will save you money. The best time of the month to refinance your mortgage is the last two weeks of the month. The best time of the quarter to refinance your mortgage is the last. Generally, a mortgage refinance is a good idea if it will save you money. Mortgage experts say you should consider this move if you can lower your interest rate. If your goal is to reduce your monthly payments as much as possible, you will want a loan with the lowest interest rate for the longest term. If you want to pay. If rates drop significantly and can result in substantial savings, then refinancing is worth considering. However, it's crucial to weigh the. In this case, refinancing may make it possible to obtain a lower interest rate or receive approval for a loan type that was previously unavailable to you. You. If rates drop significantly and can result in substantial savings, then refinancing is worth considering. However, it's crucial to weigh the. Generally speaking, you can benefit from mortgage refinancing if interest rates have dropped since you took on your mortgage. If you took out a mortgage. Most experts recommend refinancing a mortgage if you can lower your current interest rate by at least to 1 percent. Also, it's a good idea not to plan to. To Capitalize on a Lower Interest Rate and Payment. It's always wise to refinance your mortgage if the refinancing option's interest rates will save you money. The best time of the month to refinance your mortgage is the last two weeks of the month. The best time of the quarter to refinance your mortgage is the last.

A study by Black Night found that over five million homeowners with good credit and equity could save $ per month on average if they refinanced. They also. Compare these top lenders to find the right home loan for refinancing. Here are the best mortgage refinance lenders to consider. Bank of America is the best bank for mortgage refinances in many situations as you can apply online or at one of its many branch locations nationwide. This. When to Consider Refinancing · Mortgage rates are lower than when you closed on your current mortgage. · Your financial situation has improved. You can secure a. The average homeowner in the United States sells or refinances within the first 10 years of purchase. That's why lenders use the yield on a year Treasury. The best time of the month to refinance your mortgage is the last two weeks of the month. The best time of the quarter to refinance your mortgage is the last. Getting a mortgage with a lower interest rate is one of the best reasons for most homeowners to refinance. People might consider refinancing. So, if your credit score or financial situation has improved significantly since getting your current loan, it may be a good time to refinance. Of course. Falling interest rates When interest rates are going down it can be a good time to refinance. You can either keep your current loan term and lower your. Best Mortgage Refinance Lenders · Flagstar Bank: Best for Online Closing Process · PNC Bank: Best for Medical Professionals · Chase: Best for Relationship. When is the Best Time to Refinance a Mortgage · 1. Mortgage interest rates are falling · 2. You got married · 3. Home values are increasing · 4. You came into. With today's historically low rates, now is a good time to begin considering refinancing your mortgage with Assurance Financial. What Does It Mean to Refinance? Choosing an Appropriate Loan Term While year fixed rate loans remain the most popular mortgage, refinancing borrowers often choose a , or year. A good rule of thumb is to wait until rates are at least 1% lower than your current rate before you refinance. Refinancing can potentially lower your monthly mortgage payment, pay off your mortgage faster or get cash out for that project you've been planning. The Best Times to Refinance Your Mortgage · During the Break-Even Period · When Mortgage Rates are Low · When Your Credit Score Has Improved · To Tap Into Home. Should I Refinance My Mortgage? A home refinance or a mortgage refinance is when a homeowner refinances their mortgage to a new loan (typically at a lower. The best time to refinance is usually when you can get a lower interest rate1 than the one available on your existing loan. However, the decision isn't always. Best refinance lender overall: Guaranteed Rate · Best online mortgage refinance experience from a traditional bank: Chase · Best for online refinance rate. If you want to refinance your mortgage, the best time is when interest rates are lower than your current interest rate. This allows you to save money on.

Free Games U Can Win Real Money

Skillz Games is one of the premier platforms for playing free games that can earn you real money. Once you've registered an account, you can compete in a wide. The JustPlay app is only available for Android and, like Mistplay, it rewards you when you download and play games. How do I earn money? JustPlay gives you. Qmee and Dave are both two apps that I use when I need to make a quick buck. Instant cashout for surveys or games. Treat yourself to fun & FREE puzzle & word sweepstakes games that allow you to have fun with an opportunity to win real cash rewards! Instantly play free online games, including solitaire, mahjong, hidden object, word, casino, card and puzzle games. Play on your computer, tablet or phone. Play Games. Win Cash. Compete in video game tournaments for cash prizes or play head to head for real money. Sign Up Now for Free Get up to a % match on. Play To Win offers the authentic Vegas casino experience! Fun, free slots and bingo, exciting tournaments, with the added excitement of Sweepstakes Cash Prizes. Pocket7Games is the only competitive social gaming platform where anyone can play a variety of games versus real opponents to win real money and cash. Pocket7Games—the premier all-in-one gaming platform where you can have fun while winning real cash! Dive into a world of 10+ arcade-style games to fill your. Skillz Games is one of the premier platforms for playing free games that can earn you real money. Once you've registered an account, you can compete in a wide. The JustPlay app is only available for Android and, like Mistplay, it rewards you when you download and play games. How do I earn money? JustPlay gives you. Qmee and Dave are both two apps that I use when I need to make a quick buck. Instant cashout for surveys or games. Treat yourself to fun & FREE puzzle & word sweepstakes games that allow you to have fun with an opportunity to win real cash rewards! Instantly play free online games, including solitaire, mahjong, hidden object, word, casino, card and puzzle games. Play on your computer, tablet or phone. Play Games. Win Cash. Compete in video game tournaments for cash prizes or play head to head for real money. Sign Up Now for Free Get up to a % match on. Play To Win offers the authentic Vegas casino experience! Fun, free slots and bingo, exciting tournaments, with the added excitement of Sweepstakes Cash Prizes. Pocket7Games is the only competitive social gaming platform where anyone can play a variety of games versus real opponents to win real money and cash. Pocket7Games—the premier all-in-one gaming platform where you can have fun while winning real cash! Dive into a world of 10+ arcade-style games to fill your.

Play skill-based games on EazeGames and win real cash prizes. Learn fun ways to make money online! Freecash is a legitimate website where you can earn real cash for playing mobile games, taking surveys, or signing up for free trials. You can exchange in. Real Money Earning Games on MPL · What are money-earning games? · How do I earn money in these games on MPL? · Are all money-earning games free to play? · Can I. Cash Storm Casino - Online Free Vegas Slots Games This digital download is only available for Android devices. Yes, you can win real money in Playoff (available in 46 states due to limitation of cash games regulations). Can you win big money? Yes, totally! You can also sign up for Freecash. It operates similarly to Swagbucks with the option to play games and earn money. Complete an 'offer' to earn coins. These. You can win real money, gift cards, and prepaid Visa cards. It Long Game lets you win cash rewards for playing mini-games and trivia. These games fall into various categories, including skill-based games, casino games, mobile eSports, GPT (Get-Paid-To) apps, and social gaming. Lucktastic is neither a rewards site nor a multiplayer gaming app. Instead, it is a simple free app where you can play games and win money. Moreover, you can. Play Games. Win Cash. Compete in video game tournaments for cash prizes or play head to head for real money. Sign Up Now for Free Get up to a % match on. Big Cash Web Big Cash Web stands out as a premier platform for gamers looking to earn. With a staggering total of over $20,, paid to its. Why it stands out: BrainBattle makes payouts only through PayPal, making it one of the best games that will pay you instantly. Pros. Chance to win huge rewards. At Gembly you can win real prizes by playing the best free online card games, board games and puzzles such as Pyramid Solitaire 2, Klondike Solitaire. Yes, you can make money by playing games online. It's not too good to be true! It's not just for live-stream gamers who get paid, from sponsors, to play video. This is why we offer a reward system, where you can earn real money by playing games on our platform. Our daily bonuses and rewards will keep you motivated. Freecash is one of the best game sites to win real money. You can also take surveys, refer friends, and more to earn points. This site started in and is. Participate in our free tournaments and stand a chance to win real cash prizes. Game Champions hosts regular Sweepstakes contests, giving you the thrill of. We aim to change the way you play games. We (finally!) found a way to reward you for your love of gaming. No longer will you strive to gain virtual currency. It's the ultimate game of chance. Predict where the ball will land on the wheel and potentially win a massive prize. By playing for free you can fully learn the. Our collection of free online games, including Doubly Bubbly, MONOPOLY Daily Free Parking and Tiki's Catch of the Day, gives you the chance to win real cash.

Best Voice Over Ip

Which are the best VoIP service providers? · Five9 · Vonage · Webex Calling by Cisco · CloudTalk Voice · CallRail Lead Center · Ooma Office · Zoom Phone. VoIP stands for Voice over Internet Protocol. While the term itself might sound complicated, the technology itself isn't. It allows users to make and. Top VoIP Providers. Choose the right VoIP Providers using real-time, up-to-date product reviews from verified user reviews. 1-VoIP Residential. This service is cloud based, and it's reliable. It's also easy to use and set up. However, it doesn't have some of the powerful extra. Voice over Internet Protocol (VoIP). VoIP calls enable rich video calling, unlike traditional PSTN phone service. Try a VoIP call on Teams Phone. List of Top VoIP service providers in the USA | Top VoIP services in the USA · SoluLab · Infograins · Rivell LLC · TruAdvantage · ETTE · VCS Telecom, LLC. · PCG. Starting at $ per month with an annual plan, AXvoice is one of the best bang-for-your-buck residential VoIP providers we've encountered. The service bundles. Ooma is one of the best small-business phone services available because of its reasonable price and scalable options. Although the Office and Office Pro plan. Detailed look at 12 of the top VoIP providers for your home · Callcentric is a bring-your-own-device phone company with more than 15 years of experience. Which are the best VoIP service providers? · Five9 · Vonage · Webex Calling by Cisco · CloudTalk Voice · CallRail Lead Center · Ooma Office · Zoom Phone. VoIP stands for Voice over Internet Protocol. While the term itself might sound complicated, the technology itself isn't. It allows users to make and. Top VoIP Providers. Choose the right VoIP Providers using real-time, up-to-date product reviews from verified user reviews. 1-VoIP Residential. This service is cloud based, and it's reliable. It's also easy to use and set up. However, it doesn't have some of the powerful extra. Voice over Internet Protocol (VoIP). VoIP calls enable rich video calling, unlike traditional PSTN phone service. Try a VoIP call on Teams Phone. List of Top VoIP service providers in the USA | Top VoIP services in the USA · SoluLab · Infograins · Rivell LLC · TruAdvantage · ETTE · VCS Telecom, LLC. · PCG. Starting at $ per month with an annual plan, AXvoice is one of the best bang-for-your-buck residential VoIP providers we've encountered. The service bundles. Ooma is one of the best small-business phone services available because of its reasonable price and scalable options. Although the Office and Office Pro plan. Detailed look at 12 of the top VoIP providers for your home · Callcentric is a bring-your-own-device phone company with more than 15 years of experience.

10 best residential VoIP providers that offer great value for money · 1. AXvoice. AXvoice is a digital VoIP provider offering users more flexibility in their. 1. CallHippo. CallHippo tops our list of the best VoIP providers for all the right reasons. This feature-rich cloud-based business phone system has an easy-to-. Voice over Internet Protocol (VoIP), is a technology that allows you to make voice calls using a broadband Internet connection instead of a regular (or analog). The best VoIP providers like RingCentral offer unified communications with VoIP solutions to streamline your business communications into one user-friendly. Best VoIP phone services. Google Voice: Best for new users. Dialpad: Most advanced AI integrations. Intermedia Unite: Best traditional on-premise provider. For users, Voice over IP will work and feel mostly the same as using traditional telephones and landlines. In simple terms, when an outgoing call is placed from. Discover the best VoIP Phones in Best Sellers. Find the top most popular items in Amazon Office Products Best Sellers. The tradeoff is that VoIP requires a stable internet connection to work. But if you have good internet, a VoIP phone can save you money and give. Simplify business communications with an affordable and secure analog-to-digital gateway to the Verizon wireless network. Resources. 1. iFax · Secure VoIP calls and text messaging · HIPAA-compliant internet fax · Audit logs · 24/7 live chat and phone support · Android and iOS apps · BAA. Unlimited business VoIP phone calls nationwide, text messaging, conferencing, and team chat from $/mo. See why over a million people use Nextiva. Maximize VoIP services with top-of-the-line IP desk phones To make the most out of your VoIP telephone services, RingCentral offers high-quality desktop VoIP. Compare the best VoIP services designed for businesses. Our comprehensive list allows you to weigh features, prices, and benefits, ensuring you find the top. Featured VoIP Providers ; 51 Logo Globallinx Voip Provider. Headquarter: United States. Availability: Worldwide, United States ; Ycvlogs. Headquarter: United. The Best VoIP Phone Services (In-Depth Review) · #1 – Nextiva Review — The Best Overall · #2 – Ooma Office Review — The Best for Adding VoIP to Existing SMB. Bottom line: VoIP is best for businesses. For many small businesses, VoIP represents a significant upgrade in communication features and cost-effectiveness. RingCentral MVP: VoIP business phone systems are great for collaboration, and this system maximizes those capabilities. The platform allows for up to VoIP Office integrates seamlessly with most business-critical apps and services, such as Salesforce, SugarCRM, Zendesk, ZOHO, MS Dynamics, and many more. Even in the age of emails, texts, and DMs, sometimes talking to a real human solves the problem fastest. Our integrated voice solution syncs with all other. Mobile VoIP providers are the bridge that allows you to combine cellular and VoIP technology. With the explosion of Wi-Fi and powerful 4G LTE, and soon to.

1 2 3 4 5 6