mirkuhni74.ru

Tools

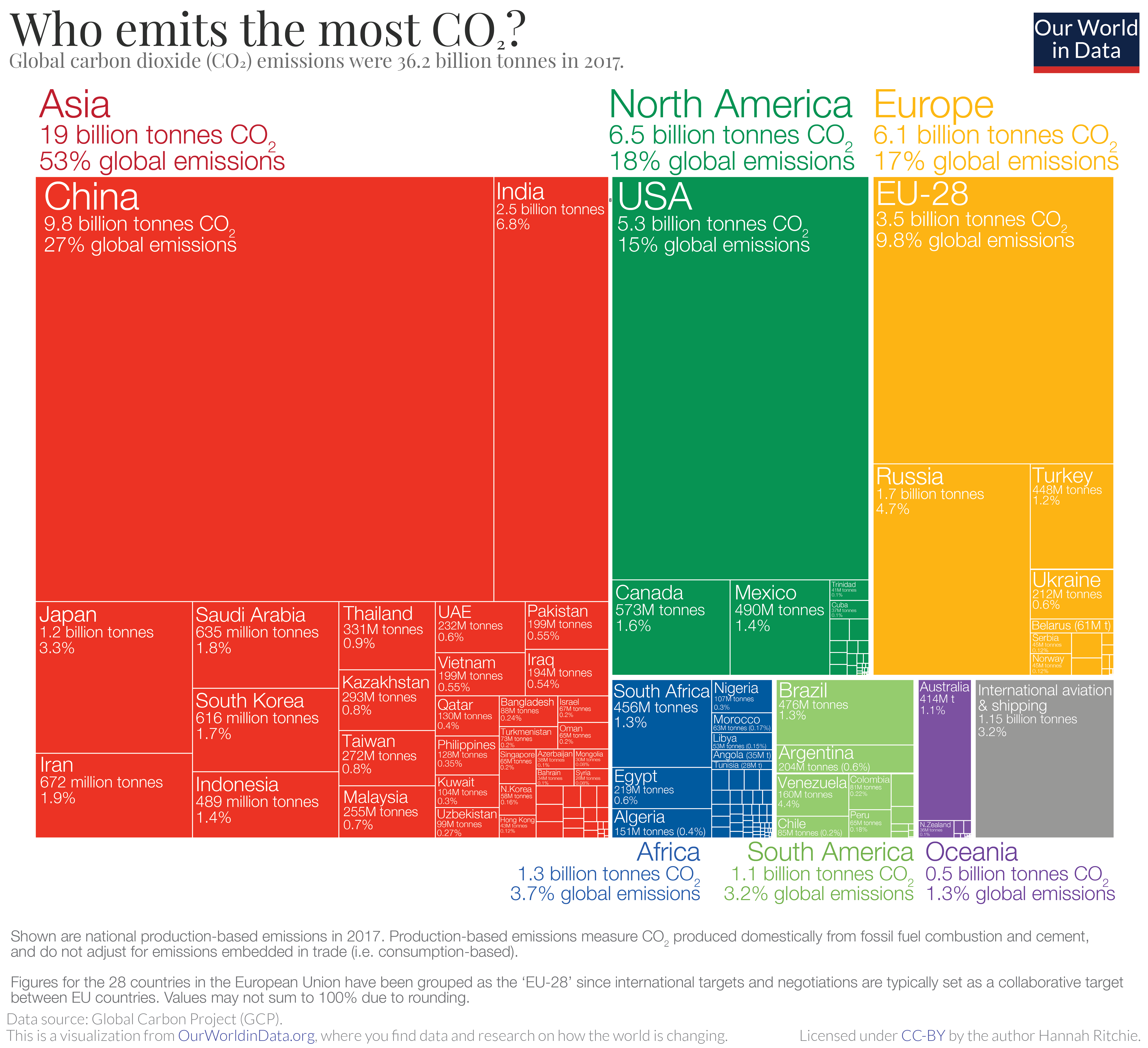

Who Emits The Most Co2

China emits the most CO2 globally. In , it released 12, million tons (gigatons) of CO2. Palau had the highest emissions per capita, 59 million. Some people emit much more carbon dioxide than others. Worldwide, the average person produces about four tons of carbon dioxide each year. In the United States. The US, China and Russia have cumulatively contributed the greatest amounts of CO 2 since The data only consider carbon dioxide emissions from the burning. Different fuels emit different amounts of carbon dioxide (CO 2) in relation to the energy they produce when burned. CO2 sequestered by trees as well as any gases emitted during forest fires. Importantly, all these pollutants are more powerful than CO2 per ton and most are. Natural CO2 sources account for the majority of CO2 released into the atmosphere. Oceans provide the greatest annual amount of CO2 of any natural or. In , China, the United States, the EU27, India, Russia and Japan remained the world's largest CO2 emitters. Together they account for % of global. Recently, however, Asia, more specifically China, have produced the most CO2 mirkuhni74.ru is due to China's economy and industry within decades rapidly. Burning fossil fuels generates most CO2 emissions, which persists in the atmosphere for up to years. The next most abundant GHG is methane. China emits the most CO2 globally. In , it released 12, million tons (gigatons) of CO2. Palau had the highest emissions per capita, 59 million. Some people emit much more carbon dioxide than others. Worldwide, the average person produces about four tons of carbon dioxide each year. In the United States. The US, China and Russia have cumulatively contributed the greatest amounts of CO 2 since The data only consider carbon dioxide emissions from the burning. Different fuels emit different amounts of carbon dioxide (CO 2) in relation to the energy they produce when burned. CO2 sequestered by trees as well as any gases emitted during forest fires. Importantly, all these pollutants are more powerful than CO2 per ton and most are. Natural CO2 sources account for the majority of CO2 released into the atmosphere. Oceans provide the greatest annual amount of CO2 of any natural or. In , China, the United States, the EU27, India, Russia and Japan remained the world's largest CO2 emitters. Together they account for % of global. Recently, however, Asia, more specifically China, have produced the most CO2 mirkuhni74.ru is due to China's economy and industry within decades rapidly. Burning fossil fuels generates most CO2 emissions, which persists in the atmosphere for up to years. The next most abundant GHG is methane.

Weather's Coming Impact on Economic Growth · Qatar is by Far the Largest per Capita CO2 Polluter · See more thoughts Filter. emitted, such as carbon dioxide (CO₂), methane (CH₄), and nitrous oxide (N₂O), each with a greater or lesser ability to trap heat in the atmosphere. Most of the CO2 emissions in Mexico come from electricity production and transportation. The per capita emissions from burning fossil fuel in Brazil are half of. The main greenhouse gas produced by vehicles is carbon dioxide (CO 2), but they also produce nitrous oxide and methane. Light vehicles account for around Since , China has been emitting more CO 2 than any other country. However, the main disadvantage of measuring total national emissions is that it does not. The trend in emissions per person is less consistent, but has been downward for most of the last 20 years. The amount of carbon dioxide equivalent emitted. Energy Information Administration FAQs: "Different fuels emit different amounts of carbon dioxide (CO2) in relation to the energy they produce when burned. The U.S. Energy Information Administration estimates that in , the United States emitted million metric tons of energy-related carbon dioxide. That CO2 that was liberated when the Industrial Revolution started is still there. It absolutely counts. The countries that have polluted more. The planet naturally releases and absorbs far more carbon dioxide than humans emit by burning fossil fuels. The problem is that human activities have thrown. CO2 emissions (metric tons per capita) from The World Bank: Data. All Countries and Economies. Country. Most Recent Year. Most Recent Value. About 90 per cent of the world's carbon emissions comes from the burning of fossil fuels, and most of Australia's emissions also comes from energy production. Which companies emit the most CO2? · China Coal % · Saudi Aramco % · Gazprom OAO % · National Iranian Oil Co % · ExxonMobil Corp % · Coal India. CH4 is the second highest emitting GHG in California, accounting for % of GHG emissions in CO2 equivalent units. Sources of CH4 in California. China is the largest emitter of carbon dioxide in the world. · 87% of human-produced carbon dioxide is emissions from burning of fossil fuels. A quarter of all GHG emissions are from food production, and agriculture is the biggest contributor of methane and nitrous oxide. The majority of emissions are. This overall growth contrasts with the electricity sector, which was the highest-emitting sector until transportation surpassed it in Transportation. Carbon dioxide (CO2) is an important heat-trapping gas, also known as a greenhouse gas, that comes from the extraction and burning of fossil fuels (such as coal. China emits the most CO2 globally. In , it released 12, million tons (gigatons) of CO2. Palau had the highest emissions per capita, 59 million. Human activities such as the burning of oil, coal and gas, as well as deforestation are the primary cause of the increased carbon dioxide concentrations in the.

Can I Use My Ira To Invest In Real Estate

This article is a nice summary, and answers many of your questions. No, you can't use the IRA to buy property from yourself. Yes, all rent goes. An IRA can only be used to purchase investment property, so you cannot build a house using the account even if you intend to use it as an investment property. Everything you need to know about investing in real estate with a self-directed IRA. Explore the process, IRS rules, paperwork & investment opportunities. In a self directed IRA you can invest in real estate. There are certain rules you need to prevent disqualifying your IRA but you can have the. Everything you need to know about investing in real estate with a self-directed IRA. Explore the process, IRS rules, paperwork & investment opportunities. To do this, you must have a self-directed IRA at a company like NuView Trust. But, what's the benefit of owning real estate inside of an IRA? Most investors. The answer is always no. IRS regulations don't allow transactions that are considered “self-dealing,” and they don't allow your self-directed IRA to buy. What Types of Properties Can I Invest in with a Real Estate IRA? A Self-Directed IRA can legally invest in almost any asset. The only assets that are off-limits. It's possible to use funds from an individual retirement account, penalty-free, to buy a house, even if you aren't six months away from your 60th birthday. This article is a nice summary, and answers many of your questions. No, you can't use the IRA to buy property from yourself. Yes, all rent goes. An IRA can only be used to purchase investment property, so you cannot build a house using the account even if you intend to use it as an investment property. Everything you need to know about investing in real estate with a self-directed IRA. Explore the process, IRS rules, paperwork & investment opportunities. In a self directed IRA you can invest in real estate. There are certain rules you need to prevent disqualifying your IRA but you can have the. Everything you need to know about investing in real estate with a self-directed IRA. Explore the process, IRS rules, paperwork & investment opportunities. To do this, you must have a self-directed IRA at a company like NuView Trust. But, what's the benefit of owning real estate inside of an IRA? Most investors. The answer is always no. IRS regulations don't allow transactions that are considered “self-dealing,” and they don't allow your self-directed IRA to buy. What Types of Properties Can I Invest in with a Real Estate IRA? A Self-Directed IRA can legally invest in almost any asset. The only assets that are off-limits. It's possible to use funds from an individual retirement account, penalty-free, to buy a house, even if you aren't six months away from your 60th birthday.

Since your IRA pays for the investment, not you, but your IRA holds the title to the property. Prohibited transaction rules apply to direct real estate. Paying for IRA Real Estate Expenses is Prohibited. Just as all proceeds of a sale, and growth in the value of an IRA investment, must stay within the IRA, all. The IRS also requires that any real estate owned in your IRA be strictly for investment purposes only. That means you and your family members cannot use it for. Yes! Buying real estate with an IRA for investment purposes is allowed. IRA law does not prohibit investing in real estate. However, not all IRA custodians or. At IRA Financial we are frequently asked if you can use your IRA to buy an investment property. The answer is absolutely, when you have a Self-Directed IRA! The answer is always no. IRS regulations don't allow transactions that are considered “self-dealing,” and they don't allow your self-directed IRA to buy. In effect, you cannot use any of the real estate in this special IRA for your personal benefit. Violations of the prohibited transaction rules result in. Do I have to cash out my IRA to invest in real estate? No. You do not have to take cash from your IRA to invest. Your IRA can buy real estate with funds in. Real estate can be an attractive investment option for self-directed IRA owners. Just make sure you understand what you can and cannot do with your investment. One of the primary rules is that the property you purchase with your IRA must be used only as an investment. You cannot live in or use the property for work. Can my IRA invest in a newly formed entity that will invest in real estate? Is It a Good Idea To Use My IRA To Buy a Home? Generally speaking, no. By withdrawing money from your IRA, you will lose out on years of compound interest. However, you can use your Roth IRA to invest in alternative investments such as real estate. I am Self-Employed, can I use my Solo (k) to Invest in Real. IRAs allow account holders to participate in direct real estate investments, but the key is finding an IRA provider who is willing to service this type of. Self-directed IRAs allow investors to take control of their retirement savings by offering a wider range of investment options, including real estate. By. How to Invest in Real Estate Using an IRA Unfortunately, most retirement plans restrict your ability to purchase real estate, aside from REITs and stocks. It's a little known fact, but yes you can indeed buy real estate within an IRA account. Question #2 – What Types of IRA Accounts can I use to Buy Real Estate? If you purchase a property you'd like to eventually retire to through an IRA and use it as a rental property, the rental income can be used to pay off the. In fact, it is possible to use both your k and individual retirement accounts (IRAs) to invest in real estate. And contrary to popular belief, it is possible. This report will give you detailed information on Self-Directed IRA real estate investing. Page 4. 4. 1. Traditional IRA. 2. Roth IRA.

Celsius Drink Wegmans

Get Wegmans Celsius Sparkling Arctic Vibe, Energy Drink delivered to you in as fast as 1 hour with Wegmans same-day delivery or curbside pickup. Drink 7-Eleven Teams with. FL.., 12/Carton Celsius Drink Near Me Thirst Quencher, Glacier Freeze Flavored Wegmans Pure Coconut Water Wegmans. Get Wegmans Celsius Sparkling Lemon Lime, Energy Drink delivered to you in as fast as 1 hour with Wegmans same-day delivery or curbside pickup. Wegmans Salted Sweet Cream Butter Quarters. 4 ct · $ Wegmans Sour Cream. 16 oz · $ fairlife Fairlife 2% Reduced Fat Ultra-Filtered Milk, Lactose Free. Get Wegmans Celsius Peach Mango Green Tea, Energy Drink delivered to you in as fast as 1 hour with Wegmans same-day delivery or curbside pickup. Another one that I really don't like is this C4, Starburst or orange or. They have so many other flavor energy drinks. This is the exact same as Celsius. Celsius Sparkling Vibe Variety Pack, Essential Energy Drink. $ /ea. 12 x 12 fl oz ($/ea). 16B - L - Section 1. Celsius Sparkling Variety Pack. Get Wegmans Celsius Sparkling Grape Rush, Energy Drink delivered to you in as fast as 1 hour with Wegmans same-day delivery or curbside pickup. Get Wegmans Celsius Sparkling Fantasy Vibe, Energy Drink delivered to you in as fast as 1 hour with Wegmans same-day delivery or curbside pickup. Get Wegmans Celsius Sparkling Arctic Vibe, Energy Drink delivered to you in as fast as 1 hour with Wegmans same-day delivery or curbside pickup. Drink 7-Eleven Teams with. FL.., 12/Carton Celsius Drink Near Me Thirst Quencher, Glacier Freeze Flavored Wegmans Pure Coconut Water Wegmans. Get Wegmans Celsius Sparkling Lemon Lime, Energy Drink delivered to you in as fast as 1 hour with Wegmans same-day delivery or curbside pickup. Wegmans Salted Sweet Cream Butter Quarters. 4 ct · $ Wegmans Sour Cream. 16 oz · $ fairlife Fairlife 2% Reduced Fat Ultra-Filtered Milk, Lactose Free. Get Wegmans Celsius Peach Mango Green Tea, Energy Drink delivered to you in as fast as 1 hour with Wegmans same-day delivery or curbside pickup. Another one that I really don't like is this C4, Starburst or orange or. They have so many other flavor energy drinks. This is the exact same as Celsius. Celsius Sparkling Vibe Variety Pack, Essential Energy Drink. $ /ea. 12 x 12 fl oz ($/ea). 16B - L - Section 1. Celsius Sparkling Variety Pack. Get Wegmans Celsius Sparkling Grape Rush, Energy Drink delivered to you in as fast as 1 hour with Wegmans same-day delivery or curbside pickup. Get Wegmans Celsius Sparkling Fantasy Vibe, Energy Drink delivered to you in as fast as 1 hour with Wegmans same-day delivery or curbside pickup.

Get Wegmans Celsius Sparkling Strawberry Lemonade, Energy Drink delivered to you in as fast as 1 hour with Wegmans same-day delivery or curbside pickup. Get Wegmans Celsius Sparkling Fuji Apple Pear, Energy Drink delivered to you in as fast as 1 hour with Wegmans same-day delivery or curbside pickup. Celsius drink has 2g carbs. Recovery drink has 5g carbs. I count total carbs and not net carbs, just a personal choice. Upvote 2. Downvote Reply. Find. Celsius Drink Near Me Energy Drinks Gatorade Frost Thirst Quencher, Glacier Freeze Flavored Wegmans. pickup. Celsius: Target. Celsius. Updated. Celsius Live Fit Energy Drink, Peach Mango + Green Tea/Blue Razz Lemonade/Raspberry Acai + Green Tea, Fizz Free, Variety Pack. 12 x 12 fl oz. spauncerd. Wegmans brand products - The Wegmans Family. Product of Canada Celsius Sparkling Grape Rush, Essential Energy Drink. 12 x 12 fl oz. $ Get Wegmans Celsius Vibe Variety Pack, Energy Drink delivered to you in as fast as 1 hour with Wegmans same-day delivery or curbside pickup. to pull up to. @Wegmans. in Corning! We're ready for ya! Image. CELSIUS Energy Drink and Wegmans Food Markets · PM · Sep 13, Wegmans % Arabica Gound Coffee, Traditional, Medium Roast, Oz. +. CELSIUS Sparkling Orange, Functional Essential Energy Drink 12 Fl Oz (Pack of 12). Made with proven, premium ingredients, 7 Essential Vitamins and zero sugar, no artificial colors, no aspartame, no high fructose corn syrup and non-GMO. CELSIUS. Get Wegmans Celsius Sparkling Oasis Vibe, Energy Drink delivered to you in as fast as 1 hour with Wegmans same-day delivery or curbside pickup. Get Wegmans Celsius Fizz Free Variety Pack, Energy Drink delivered to you in as fast as 1 hour with Wegmans same-day delivery or curbside pickup. Get Wegmans Celsius Sparkling Mango Passionfruit, Energy Drink delivered to you in as fast as 1 hour with Wegmans same-day delivery or curbside pickup. I got ID'd for Celsius at the self checkout the other day and was wondering if that has ever happened before to anyone. Loyalty CardGatorade Frost Thirst Quencher, Glacier Freeze. 15B - L - Section 4. Wegmans Zero Dragon Fruit Vitamin Infused Water. Need some help. I live in Canada, I make the trip down to Buffalo to buy my supply. But the store I go to (Wegmans) always has the same. CELH Was in Wegmans earlier and they were setting this up, no other energy drink had displays like this. Starting to see Celsius have. Get Wegmans Celsius Sparkling Peach Vibe, Energy Drink delivered to you in as fast as 1 hour with Wegmans same-day delivery or curbside pickup. Get Wegmans Energy Drinks products you love delivered to you in as fast Celsius Sparkling Vibe Variety Pack, Essential Energy Drink. 12 x 12 fl oz.

Can I Return Car To Dealer

Used Car Buyers · The buyer must return the vehicle: · To the dealer where purchased by close of business within two days, or within the time-frame allowed by the. Dealers will have you sign a Motor Vehicle Purchase Contract when you buy a car. The law requires a dealership to have you sign the contract anytime it takes a. If the dealer can't fix or replace the car, you can return it and get a full refund. You'll have six months to explain to the dealer in writing your reasons for. A dealer may decide to refund the purchase price of your car, rather than repair or replace a warranty part. If the dealer gives you a refund, you must return. The only way to get around this is to choose a dealership that allows used car returns. Average Return Period After a Used Car Purchase. There really is no. Unfortunately, it is not possible; although you have multiple options like trade in your car or resell it to another person who would be taking care of whole. Yes, you may be eligible for a refund or tax credit in either scenario, “buy back” or “lemon law.” If you did not receive a replacement vehicle from the dealer. You have a right to reject something faulty and you're entitled to a full refund within 30 days of purchase in most cases. After 30 days, you lose the short-. The dealer who agreed to repurchase your vehicle usually will handle all paperwork, particularly if the dealer has sold you another vehicle to replace the one. Used Car Buyers · The buyer must return the vehicle: · To the dealer where purchased by close of business within two days, or within the time-frame allowed by the. Dealers will have you sign a Motor Vehicle Purchase Contract when you buy a car. The law requires a dealership to have you sign the contract anytime it takes a. If the dealer can't fix or replace the car, you can return it and get a full refund. You'll have six months to explain to the dealer in writing your reasons for. A dealer may decide to refund the purchase price of your car, rather than repair or replace a warranty part. If the dealer gives you a refund, you must return. The only way to get around this is to choose a dealership that allows used car returns. Average Return Period After a Used Car Purchase. There really is no. Unfortunately, it is not possible; although you have multiple options like trade in your car or resell it to another person who would be taking care of whole. Yes, you may be eligible for a refund or tax credit in either scenario, “buy back” or “lemon law.” If you did not receive a replacement vehicle from the dealer. You have a right to reject something faulty and you're entitled to a full refund within 30 days of purchase in most cases. After 30 days, you lose the short-. The dealer who agreed to repurchase your vehicle usually will handle all paperwork, particularly if the dealer has sold you another vehicle to replace the one.

Remember, the option to return a car after purchase is at the dealer's discretion. It's not a state or federal law. However, returns do happen, but a dealer's. Dealers and companies do not have to give you a “three-day right to cancel.” Before you buy from a dealer or company, ask about the return policy, get it in. What this means is that as long as the vehicle contract is canceled within three days and miles the car can be returned. On occasion a manufacturer will run. It's always best to ask the dealership or private seller before you buy. Is it bad to return a car to the dealer because you don't like it? If you bought the. Once you return the vehicle, it's considered a default because you're no longer making payments. The car is then prepped to be sold at auction, and the proceeds. The right to return the car in a few days for a refund exists only if the dealer grants this privilege to buyers. Dealers may describe the right to cancel as a. There is no three-day right of cancellation when purchasing a vehicle at the dealer's main place of business. [Back to Top]. Documentary Service Fee. A dealer. Unfortunately, it is not possible; although you have multiple options like trade in your car or resell it to another person who would be taking care of whole. What rules govern used car sales? · whether the vehicle comes with a warranty and, if so, what specific warranty protection the dealer will provide; · whether the. Yes, if your used car breaks down or needs expensive repairs soon after you bought it from a dealer. *You cannot return a used car and cancel the sale simply. You can return the vehicle to the dealer, but if it's before the lease expires, you'll likely face some stiff early termination fees. Plus, you will still owe. When the car is returned, the dealer must give you a full refund. This includes sales tax, registration fees, deposit and return of your vehicle. If the dealer. You must return the vehicle to the dealer. The only thing the dealer can do is take the car back, refund you % of your money, and return your trade-in. Dealers offering split cost warranties can require that buyers return to the dealer for warranty repairs. If your warranty includes this restriction. Car leases have money due at signing, and you should also have your wallet ready when you return the car at the end of the lease. · Keeping a leased car clean. Does the service contract duplicate warranty coverage you already have? · Is the car likely to need repairs, and how much are they going to cost? · Will the. You have a right to reject something faulty and you're entitled to a full refund within 30 days of purchase in most cases. After 30 days, you lose the short-. Contrary to a popular rumor, there is no cooling-off period or statutory right to cancel a vehicle purchase contract, and in fact very few dealers will agree to. If placing a deposit on a vehicle, be sure that the receipt and/or contract specify that it is refundable. Buyers should be certain that they understand all the. If you refuse to return the vehicle, the dealership can come and get it back from you. If the dealer takes the vehicle back, you are entitled to a refund of.

Chrome Has Been Hacked

It usually comes every hour or so. Already scanned my device for viruses and malware but all came up clean. Attached is a screenshot of the notifications. How. Shortly followed by the hijacking of the extension, Web Developer, which was updated to inject malicious adverts into the web browsers of 1 million of its users. To update Google Chrome, open the browser and click the three vertical dots in the top right-hand corner of the window. Hover over “Help” and then press “About. Has Google Chrome been hacked? Your browser can be compromised, a hijacked browser can change your default search engine, directing you to one that spams. Step 1: Sign in to your Google Account · Step 2: Review activity & help secure your hacked Google Account · Step 3: Take more security steps. A recently patched security flaw in Google Chrome and other Chromium web browsers was exploited as a zero-day by North Korean actors in a campaign designed. In March , Google Chrome was hit by another zero-day hack according to Forbes1. Once a website has been compromised by injecting malicious. HackTools is a web extension facilitating your web application penetration tests, it includes cheat sheets as well as all the tools used during a test. Google Chrome has been hacked: ○The default search engine is different. Searching for answers on Google is almost automatic to most of us. We fire up Chrome. It usually comes every hour or so. Already scanned my device for viruses and malware but all came up clean. Attached is a screenshot of the notifications. How. Shortly followed by the hijacking of the extension, Web Developer, which was updated to inject malicious adverts into the web browsers of 1 million of its users. To update Google Chrome, open the browser and click the three vertical dots in the top right-hand corner of the window. Hover over “Help” and then press “About. Has Google Chrome been hacked? Your browser can be compromised, a hijacked browser can change your default search engine, directing you to one that spams. Step 1: Sign in to your Google Account · Step 2: Review activity & help secure your hacked Google Account · Step 3: Take more security steps. A recently patched security flaw in Google Chrome and other Chromium web browsers was exploited as a zero-day by North Korean actors in a campaign designed. In March , Google Chrome was hit by another zero-day hack according to Forbes1. Once a website has been compromised by injecting malicious. HackTools is a web extension facilitating your web application penetration tests, it includes cheat sheets as well as all the tools used during a test. Google Chrome has been hacked: ○The default search engine is different. Searching for answers on Google is almost automatic to most of us. We fire up Chrome.

Sometimes Chrome can get stuck as it launches. Forcing it to quit and restarting it usually fixes this problem. Select the Apple menu, then Force Quit. Apple. Chrome and Other Browsers. Chrome and other browsers use Safe Browsing to Malware is software specifically designed to harm a device, the software. What is a browser hijacker? A browser hijacker is a malware program that modifies web browser settings without the user's permission and redirects the user to. See our Help for Hacked Sites if you believe that your site has been hacked. Examples of social engineering violations. Deceptive content examples. Here are. If you suspect that your browser has been hijacked, shut it down immediately. Perform a full system scan with your antivirus software, which should be able to. It sounds like first you should try to get a pop up blocker. A common one is called AdBlock, you can google it and download it. Once installed it should get rid. 'My computer is acting weirdly, can you see if it's been hacked? As Google Chrome is the most widely used browser, I'll do a deeper. There is most likely nothing wrong with your computer. Fake virus popup. These are false messages designed specifically to frighten you into contacting the. Cybercrime is the fastest growing type of crime in America. According to the FBI's statistics [*]. More than , Americans got scammed online last. Safe Browsing is a service that Every day, we discover thousands of new unsafe sites, many of which are legitimate websites that have been compromised. Tells me if a domain has been hacked or leaked recently so I can act fast. Very good addon! 2 out of 2 found this helpful. Review's profile picture. Nathan. #NoHacked is our social campaign which aims to bring awareness about hacking attacks and offer tips on how to keep your sites safe from hackers. This time we. A recently patched security flaw in Google Chrome and other Chromium web browsers was exploited as a zero-day by North Korean actors in a campaign designed. HackTools is a web extension facilitating your web application penetration tests, it includes cheat sheets as well as all the tools used during a test. Can Google Password Manager Be Hacked? We saved the biggest problem with Chrome password safety for last. When you use Chrome passwords, or any browser-based. Can Google Password Manager Be Hacked? We saved the biggest problem with Chrome password safety for last. When you use Chrome passwords, or any browser-based. We do not have hosted malicious content and our servers have not been hacked or something else. Checking through VirusTotal I can see that our software URL is. Your site has been hacked. mirkuhni74.ru Check out the resources available here for some more ideas on the. Browser hijackers often infiltrate systems through deceptive apps or browser extensions, masquerading as legitimate tools like a Google Docs Chrome extension. It's a great tool that is super easy to use. Chrome will let you know exactly which passwords are compromised and need updating (see below). chrome password.

Limit Buy Order

A limit order is an order to buy or sell a security at a specific price. A buy limit order can only be executed at the limit price or lower. Sell limit orders state the minimum price at which to sell, and can only be executed at the limit price or higher. Although a limit order enables you to specify. A limit order is used to buy or sell a security at a pre-determined price and will not execute unless the security's price meets those qualifications. A limit order is an instruction you give to buy or sell an asset at a specific price. The instruction is usually given to a broker that will automatically. Limit orders allow you to specify the minimum price at which you will sell, or the maximum at which you will buy, an asset. If you want to open an order to buy. A limit order is an order to buy or sell a stock at a specific price or better. A buy limit order can only be executed at the limit price or lower. A buy limit order can be executed only at or below the limit price; a sell limit order can be executed only at or above the limit price. This means you're. A limit order in financial markets is an instruction to buy or sell a stock or other security at a specified price. When you place a limit order to buy, the stock is eligible to be purchased at or below your limit price, but never above it. You may place limit orders either. A limit order is an order to buy or sell a security at a specific price. A buy limit order can only be executed at the limit price or lower. Sell limit orders state the minimum price at which to sell, and can only be executed at the limit price or higher. Although a limit order enables you to specify. A limit order is used to buy or sell a security at a pre-determined price and will not execute unless the security's price meets those qualifications. A limit order is an instruction you give to buy or sell an asset at a specific price. The instruction is usually given to a broker that will automatically. Limit orders allow you to specify the minimum price at which you will sell, or the maximum at which you will buy, an asset. If you want to open an order to buy. A limit order is an order to buy or sell a stock at a specific price or better. A buy limit order can only be executed at the limit price or lower. A buy limit order can be executed only at or below the limit price; a sell limit order can be executed only at or above the limit price. This means you're. A limit order in financial markets is an instruction to buy or sell a stock or other security at a specified price. When you place a limit order to buy, the stock is eligible to be purchased at or below your limit price, but never above it. You may place limit orders either.

When you place a market order, you are asking to buy or sell promptly at the current market price. With a limit order, you're stipulating that you want the. A buy stop limit is used to purchase a stock if the price hits a specific point. It helps traders control the purchase price of stock once they've determined an. Selling shares using limit orders lets you sell your shares at a price that you're happy with. If the price reaches this or higher, the order will be filled. If. When a buy limit order is placed with a price higher than the current market price, the limit order functions as a market order, offering market protection. A limit order is an order to either buy stock at a designated maximum price per share or sell stock at a minimum price share. A buy limit order is an order that instructs your broker to buy a stock or other security only at a specific maximum price. In other words, if you enter a buy. A buy limit order deals with the purchasing of a specified quantity of securities at or below a stipulated price. Using buy limit orders is a common practice. A limit order might be used when you want to buy or sell at a specific price. If you are concerned about risks to the market, one action you can take is to. A buy limit order is used to buy a security at a specified price or lower, while a sell limit order is used to sell a security at a specified price or higher. With a buy limit order, the buyer is guaranteed to pay that stock price or less. While the price is guaranteed, the filling of the limit order is not, and the. A limit order ensures that you get a price for a stock or an ETF in the range you set—the maximum you're willing to pay or the minimum you're willing to accept. A Limit order is an order to buy or sell at a specified price or better. The Limit order ensures that if the order fills, it will not fill at a price less. A limit order is an instruction for a broker to buy a stock or other security at or below a set price, or to sell a stock at or above the indicated price. A Buy Limit Order is an order placed below the current market price. A market order is designed to execute at a stock's current price—the market price—when the order reaches the exchange. You'll buy at the ask price or sell. For sell limit orders, you're setting a price floor — i.e. the lowest amount you'd be willing to accept per share. If a trader places a limit order to sell, the. A limit order is a request to buy or sell an asset, but only if you can do so at a certain price or better. A limit order is an order type that specifies the price at which the trade will be executed. A limit order allows you to buy or sell a stock at a set price in. A sell limit order is a limit order that an investor can use to sell stock at a specified price or above the specified price. Opposite of a buy limit order, a. Investors use limit orders to seek better prices. For example, if the stock's price is $55, a customer could place a buy limit at $ If the order executes.

How Much Can You Claim For Donations

For example, if you have $25, in taxable income this year and donate 60% of that, or $15,, to charity, you will receive the deduction for the whole gift. Yes, with some caveats. The main caveat is that to claim a deduction you have to itemize your deductions, instead of taking the standard deduction. If a donor is claiming over $5, in contribution value, there is a section labeled “Donee Acknowledgement” in Section B, Part IV of Internal Revenue Service . Understand the Limits: There is a threshold to how much you can claim in a year. Typically, you can claim up to 75% of your net income for the year. However. Donation bunching is a tax strategy that consolidates your donations for two years into a single year to maximize your itemized deduction for the year you make. 6. There are limits to how much you can deduct. The rule of thumb is that you can deduct up to 60% of your adjusted gross income through charitable donations. If you itemize deductions, gifts of cash to qualified public charities can be deducted in an amount up to 60% of your adjusted gross income (AGI) in a given. Your deduction limit will be 60% of your AGI for cash gifts. Note that if you're planning a large donation that's close to or exceeds your AGI limit, you may. In many cases, charitable donations are tax-deductible. When you donate to a qualifying organization, you can deduct the amount from your taxable income if you. For example, if you have $25, in taxable income this year and donate 60% of that, or $15,, to charity, you will receive the deduction for the whole gift. Yes, with some caveats. The main caveat is that to claim a deduction you have to itemize your deductions, instead of taking the standard deduction. If a donor is claiming over $5, in contribution value, there is a section labeled “Donee Acknowledgement” in Section B, Part IV of Internal Revenue Service . Understand the Limits: There is a threshold to how much you can claim in a year. Typically, you can claim up to 75% of your net income for the year. However. Donation bunching is a tax strategy that consolidates your donations for two years into a single year to maximize your itemized deduction for the year you make. 6. There are limits to how much you can deduct. The rule of thumb is that you can deduct up to 60% of your adjusted gross income through charitable donations. If you itemize deductions, gifts of cash to qualified public charities can be deducted in an amount up to 60% of your adjusted gross income (AGI) in a given. Your deduction limit will be 60% of your AGI for cash gifts. Note that if you're planning a large donation that's close to or exceeds your AGI limit, you may. In many cases, charitable donations are tax-deductible. When you donate to a qualifying organization, you can deduct the amount from your taxable income if you.

These increased limits, raised over the previous limit of 50%, is actually good news for charities. How to Maximize Your Tax Deduction Through Charitable Giving. How much can you deduct for the gently used goods you donate to Goodwill? The IRS allows you to deduct fair market value for gently-used items. The quality. How much can you deduct for noncash gifts? · 50% AGI limit for most noncash donations · 30% AGI limit for capital gain property (assets like stocks, bonds, or. To deduct a noncash donation totaling more than $, you will have to fill out Form and submit it with your return along with any other required. You can qualify for taking the charitable donation deduction without a receipt; however, you should provide a bank record (like a bank statement, credit card. Expenses that build up because of volunteering activities are also deductible. Important: The rules for deducting charitable contributions have changed for tax. The aggregate deduction shall not exceed 35% of your income after allowable expenses and depreciation allowances or assessable profits. If you have more than. Can I claim a charitable deduction if I received a gift in return? Yes, you can still deduct charitable donations in this instance, as long as the goods or. You can claim the following tax credits on line for one or more donations and gifts: the tax credit for charitable donations and other gifts. To deduct a noncash donation worth less than $, you need a receipt with: If you're giving securities, you should also document the name of the issues, the. Long-term appreciated assets—If you donate long-term appreciated assets like bonds, stocks or real estate to charity, you generally don't have to pay capital. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your Goodwill donations. You can claim the full amount of the donation as long as it is $2 or more. There is no limit to how much you can claim. With the reduction of many federal tax deductions, charitable giving is one of the only levers you can easily adjust to surpass the standard deduction and. You can take a tax deduction for charitable donations made to a qualified organization. You may donate between 1% and 2% of your annual income. How do tax deductions on donations work? Ah, the million-dollar question. When you make a charitable donation, you can deduct the value of your donation from. You can claim the full amount of the donation as long as it is $2 or more. There is no limit to how much you can claim. In general, you can get a credit for all donations to registered charities, up to 75% of your net income. In the year of death (and going back one year). Then in they take the $29, standard deduction. With this option, the couple has $5, of additional tax deductions over the two years. In addition, if. Noncash Charitable Contributions — applies to deduction claims totaling more than $ for all contributed items. If a donor is claiming over $5, in.

Futures Trading Signal Service

Start trading like an expert today with Super Trend Signals. Get an edge with our automated trading signals, designed for consistent profits. The signal service does not constitute and should not be regarded as investment advice. exchange traded futures contract, option on a futures contract. Free real-time day trading signals service by Ilan Levy-Mayer who is a registered commodity futures trading advisor. Call today () to learn more! Ok! Centralcharts uses cookies to enable us to provide content and services. You are also informed about trading risks and you have read the terms and. THE ALGORETURNS FUTURES TRADING SYSTEM: TRIDENT SIGNAL MENU AlgoReturns is a futures trading research provider with a unique technology and IP platform which. As of my Experience VIP09 is the Best Binance Futures Trading Signals Provider on Telegram. Why? Because 1. His Signals are one of the best. Trading Signals is a trading service that allows the automatic real-time copying of trading from one trading account to another. What I imply by 'honest forex signal provider I have the knowledge to lessen ppls learning curve trading futures and I have profitable months. New % Buy and Sell Stocks Opinions, with TrendSpotter, Short, Medium, and Long-term Indicator futures predictions and ratings. Start trading like an expert today with Super Trend Signals. Get an edge with our automated trading signals, designed for consistent profits. The signal service does not constitute and should not be regarded as investment advice. exchange traded futures contract, option on a futures contract. Free real-time day trading signals service by Ilan Levy-Mayer who is a registered commodity futures trading advisor. Call today () to learn more! Ok! Centralcharts uses cookies to enable us to provide content and services. You are also informed about trading risks and you have read the terms and. THE ALGORETURNS FUTURES TRADING SYSTEM: TRIDENT SIGNAL MENU AlgoReturns is a futures trading research provider with a unique technology and IP platform which. As of my Experience VIP09 is the Best Binance Futures Trading Signals Provider on Telegram. Why? Because 1. His Signals are one of the best. Trading Signals is a trading service that allows the automatic real-time copying of trading from one trading account to another. What I imply by 'honest forex signal provider I have the knowledge to lessen ppls learning curve trading futures and I have profitable months. New % Buy and Sell Stocks Opinions, with TrendSpotter, Short, Medium, and Long-term Indicator futures predictions and ratings.

The Trading Signals service in MetaTrader 5 is the ready solution for traders. Futures Association and the Commodity Futures Trading Commission, with. trade commodities, use a commodity signal service, etc. Manual and automatic trading signals. There are different methods to generate trading signals. As. 3 years+ of performance tracked on myfxbook. *Please note, past performance is not indicative of future results. Trading the foreign exchange, futures market. FULL RISK DISCLOSURE: The following statement is furnished pursuant to Commodity Futures Trading Commission (“CFTC”) Regulation (c).This brief statement. How to get the signals? Entry signals for our micro-indexes: MES, MNQ, MYM and M2K are free for all. We also provide signals for E-mini (ES, NQ. Our answer: We designed this service, leveraging a trading strategy and at Question: Are you trading futures? Our answer: No certainly not. Index Futures – SP (pit based, $ per point), ES (Emini S&P, electronic, $50 per point); Index Options – SPX. All these instruments are closely related and. trading forex signals service to our community. It supports numerous market data and brokerage options, offering access to trade futures, equities, forex, and. Edge Alerts is the automated algorithmic trading signals service of the Edge Suite. It provides the day trader with key timing information of when to trade. With our unique combination of Elliott Wave analysis and a wide range of technical indicators, we provide the best commodity trading signals to help you. I'm looking for some good signal trading groups, wouldn't mind paying if they have a good win rate and proof to back it up with reviews etc. SYGNAL collects millions of buy/sell trading signals from best-in-class quant teams and data scientists, making them available to both individual and. SYGNAL aggregates millions of trading signals for thousands of financial instruments, all sourced from world-class hedge funds and professional quant. market, encompassing various types such as forex, crypto, and futures signals. Each service, from the precision of forex signal services to. Futures, stock and option trading. Direct access. High-speed best price execution. Low commissions. Free real-time trading signals. Legendary support desk. Signals at a glance. Use the in-platform pane to view forex trading signals, index signals and commodity signals, including provider, direction and timeframe. On one hand, certain futures trading strategies signals are A Forex signal service delivers trading signals that originate from. In this best forex signals provider list, we have compiled the best forex trading signal providers that offer both free and paid forex services. 1. mirkuhni74.ru Live Emini S&P Futures Signals. ProTrader mirkuhni74.ru has developed the fastest day trading signal system producing LIVE S/P E-Mini signals for long and. Signal Skyline is the best and most accurate & reliable Forex trading signals services provider. Subscribe us today for FX trade alerts daily to get profit.

1 2 3 4